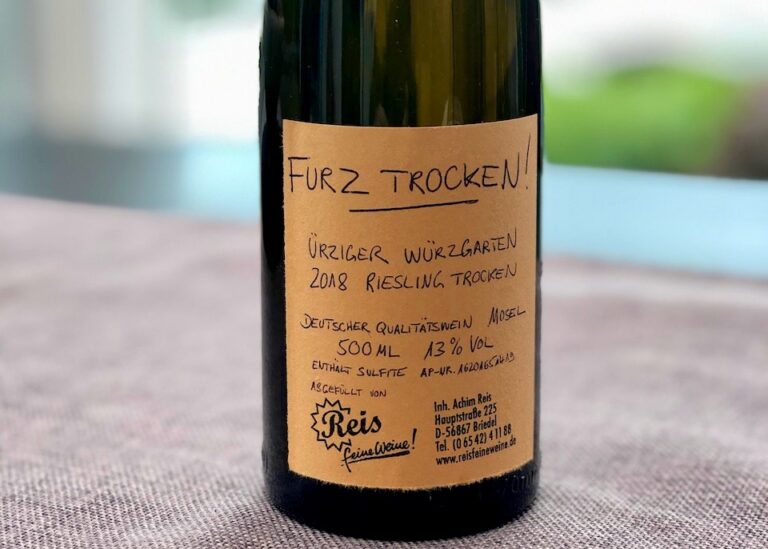

Are the British Getting a Taste for Umlauts?

We British are not the world’s most noted linguists, but that doesn’t seem to put off some of us from drinking “German-speaking” wines. That said, the market for these wines has had a rough ride at times, which makes their current increasing popularity all the more intriguing. Germany has historically boasted a well-established presence in the U.K. wine market. In the 19th- and early 20th- centuries German wines were famously on par with Bordeaux, Burgundy, Champagne, and Port in terms of price. After the fall of Napoleon, the Rhineland and the Mosel both entered a period of prosperity, initiated by…